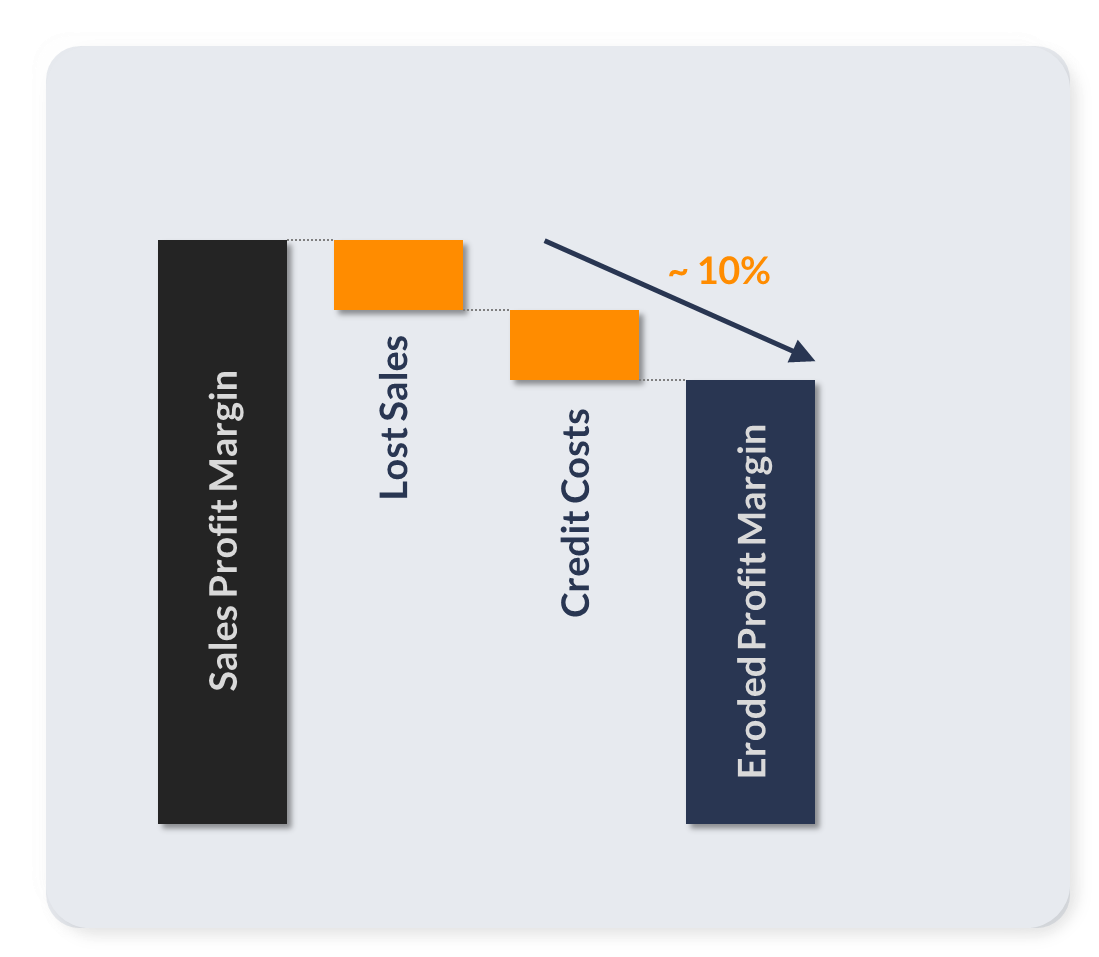

Credit is Eroding Your Profits

Too much credit increases bad debt, collections costs and cashflow problems.

But giving too little credit results in lost sales and lost opportunities.

Optimize how much credit you extend, every day. Balance risk and growth with confidence.

Too much credit increases bad debt, collections costs and cashflow problems.

But giving too little credit results in lost sales and lost opportunities.

By transforming the process into a data-driven, predictive decision engine.

Veruta runs this process on hundreds of thousands of accounts, daily.

Focused Expertise

We do one thing exceptionally well: optimizing credit limits. We do nothing except obsess about this challenge.

Learn MoreTrusted Decisions

Every recommendation is explainable, impartial and built on proven financial logic. We have FICO-grade confidence.

Learn MoreIntelligence Built For You

We build new models for every single client. We don't re-use a generic risk model. That is why our recommendations really work.

Learn MoreCredit reports look at the past. Spreadsheets are slow and error prone. People are unfortunately subjective and inconsistent.

To make the right credit decisions, you need a system that consistently predicts future sales and credit risks, then strikes the right balance.

Learn more ➔

Use Cases

In a saturated market, growth came from supporting smaller customers with more working capital, rewarding good payment behavior and driving sales higher.

Increase in average purchase volumes from smaller customers.

Identifying growth accounts among many thousands of small and mid-sized customers helped this customer automate the increase in sales of over $20M in just 6 months.

Additional sales without additional marketing efforts.

The credit team shifted from reactive firefighting to proactive tactical management without hiring additional personnel.

Number of accounts reviewed daily

Using the predictive analytics, they were able to increase their collections forecasting accuracy from 82% up to 97.5%.

Accuracy of cash collection forecasting

All the work is on our side. Once you give us access and answer a few setup questions, we can deliver a trial setup for you to evaluate.

Balance risk and growth with the most intelligent trade credit limit decision engine

Veruta - The Trusted Credit Limit Decision Engine